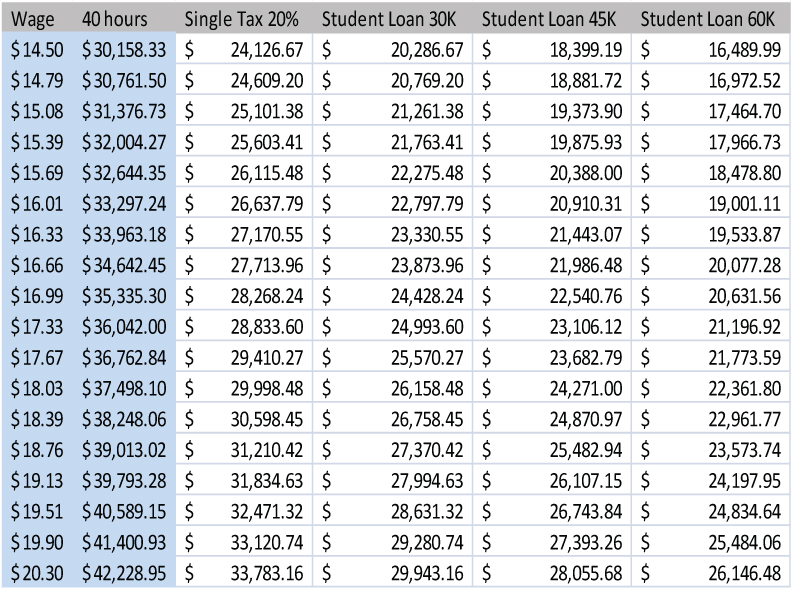

Obviously, you need to make sure that the rate is such that after expenses you have enough profit left to make working worthwhile. The above means that your chosen hourly pay can not be higher than the value you provide to your client, and it should generally include a decent margin which would constitute their profit - a compensation for the risk of undertaking whatever business venture they are in. Sometimes an employer would be willing to hire someone at a rate at which the person doesn't necessarily pay for himself through the work directly performed, if that work is absolutely necessary to allow some other activity to happen, which will bring a return that in turn justifies the salary / hourly rate. Consider the employer perspectiveįrom the point of view of an employer the calculation is simple: is it more efficient to hire this person at an XX hourly rate, or do I have better options, including just not doing the job, or hiring a less-qualified, but cheaper employee, or considering automating the work. This, of course, assumes you are covering some of the costs. When considering your hourly rate based on, say, an yearly salary, you should take into account both your regular expenses, as well as expenses that might increase or decrease depending on the volume of work you are doing. Naturally, you will also be more inclined to sign a contract for a rate that allows you to also set money aside, so you can start your own business, or buy a nicer house or car, or send your kids to a better college.

Your hourly pay is related to your living expenses only in as much as you will most likely be unwilling to work for an hourly rate that will not allow you to support yourself.

Generally, the freer an economy is, the more one's human capital plays a role in determining what income one is able to achieve. Choosing a good hourly rateĪs with the price of any good exchanged on a free market, hourly wages are determined primarily by supply and demand, which will be specific to your business niche, your expertise, sometimes to your location and language skills. Naturally, we first need to convert your salary to an yearly salary, if you enter it in some other fashion. The yearly salary is divided by the number of work hours during the year, where the number of work hours is derived by first calculating the number of work hours per day by dividing the hours per week by the work days per week, and then multiplying by the total number of work days per year. Hourly Rate = Yearly Salary / ((Hours per Week / Days per Week) x Work Days per Year) The formula for salary to hourly we use is: If you have a days-off calendar handy, you might want to check if some of the holidays also coincide with weekends, since in such cases you must exclude them from the number you input. Accounting for these is important for an accurate conversion of a salary to an hourly pay.

Also enter the days you take off work - vacation days. Finally, enter at least an approximate number of official holidays per year, assuming you do not work on holidays. It is worth mentioning that our calculator outputs not just the hourly rate, but also the equivalent daily, weekly, monthly, and yearly salary. Work days per week are required in order to calculate an equivalent hourly salary. You should be thinking about "billable hours" here, so it is best to not just use whatever is on your job contract: maybe you work overtime, or maybe you happen to work less than the contract states due to specifics of the business or just bad internal organization. Then you need to specify the number of hours per week that you are in fact working.

First, you need to specify the type of salary: yearly, quarterly, monthly, bi-weekly, weekly or daily. In order to convert your salary to an hourly rate using our salary to hourly calculator, you need to enter a few pieces of information.

0 kommentar(er)

0 kommentar(er)